How will you safeguard the family and the family business for the next generation and ensure strong governance? Create a roadmap to maximize value.

What are some key questions that you should be asking?

- How do you safeguard the family and the family business?

- What is succession planning?

- Does your family have a vision for the future? Does everyone agree with it?

- How do you make sure the owners are aligned and have a common vision for the family business?

- How will my family’s decisions affect the family business in terms of ownership and management?

- What type of ownership do you want in the business?

- How will you structure the governance of the business?

- How will you define success in the business?

- What will and won’t you communicate?

- How will you handle the transition of the business to the next generation?

- What are some issues that you need to be aware of in the transition process?

Business succession planning is the process of determining how you are going to transfer your business ownership and transition out of a business management role, while maximizing your personal financial security. In contrast, governance is how you structure your business for optimal management. For example, in a family business, attention must be paid to the family, the business and the ownership, commonly referred to as the Three-Circle Model of Family Business.[1] As such, your governance structure can include a family constitution or code of conduct, board of directors who implement the strategic plan of the business, and shareholder agreements for effective partnerships[2], respectively. These tools enable effective communication and serve as a forum for constructive management of differences in expectation of the family and the business.

Establishing and running a business requires a substantial amount of time, research, careful decision-making, and hard work. Creating a roadmap for your loved ones allows you to maximize the value of your business for your estate, and to assist your loves one with unwinding or managing your business after you die. It provides the peace of mind that your loved ones are taken care of and that liquidity is there to meet the tax obligations and costs associated with settling your estate.

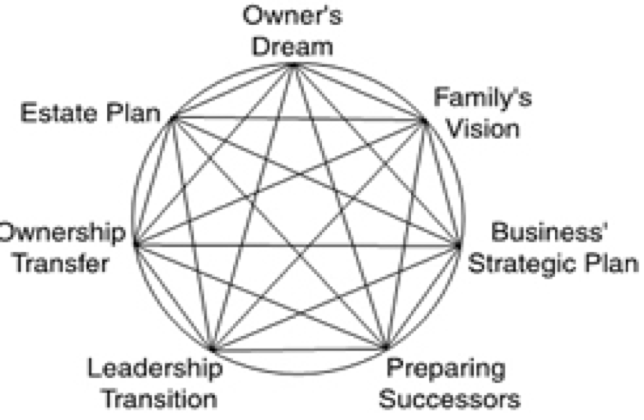

A business succession provides a business owner a plan for their family’s future and the future of their business. A succession plan can also minimize tax, improve the financial stability of the business, ensure future viability of the business, and most importantly maintain family harmony, see Figure below.

Many business owners are busy running and growing their business and therefore they tend to procrastinate when implementing a business succession plan. It is important that family businesses create opportunities where owners can have open and honest conversations about their vision for the future of the business. If you encourage positive communication, without judgement, you will have a better chance of making sure that the direction of growth for the family business is one that suits everyone. Giving your family the time to discuss and explore individual and business objectives freely also enables greater trust, can help strengthening relationships, and flourish the business through creative ideas.

Steps on how you can begin the process of succession planning:

- Determine your objective for the business ownership and management (i.e., sell, transfer) – consider various scenarios like divorce, disability and death.

- Consider your obligations. Some shareholder agreements may have provisions that get triggered on death or divorce, etc.

- Determine your hold or selling strategy (i.e., to family, employees, third party)? Also, you need to understand what your share of the business is worth if you are in partnerships.

- For a family business, is the younger generation family member ready, interested and qualified to take over?

5. Consider a shareholder agreement, insurance, and other tax minimizing strategies.

6. Ensure there is clarity on the 3-circle model – who is in the business, who is the owner and who is in the family. This family governance tool is useful to provide clarity to all involved in the business.

7. Speak with your family and advisors to guide and implement your strategy.

If you want to learn more, here are some useful links:

- Getting Started with Family Governance - The Family Business Consulting Group

- 5 steps to Succession Planning

- 3 circle model of family business

- Family Business Succession Process

[1] Barbara Dartt and Anne Hargrave. Getting Started with Family Governance. The Family Business Consulting Group. 2016

[2] KPMG. Family Business. 2018