Wealth preservation begins by taking stock of all your income and assets. Plan for the lifestyle you want at retirement, taking into account longevity.

- What is the wealth for? Who is it for?

- Why is it important for you to have family involvement in your investment strategy?

- What are your objectives in your investment and retirement strategy?

- What investment vehicles are you considering and comfortable with?

- In times of crisis, how will you deal with your plans?

- How do you plan for longevity and mental incapacity of family members?

Investment and retirement planning strategy is an essential part of your comprehensive IGWP plan. It is important to begin to prepare family members for financial leadership by modeling financial competency and family values. Families are constantly changing. A joint approach where all caregiver(s) are engaged will be a start towards a family investment strategy. Being prepared will provide a pathway to a successful transition of wealth and values to the inheriting generation.

Both wealth creation and wealth preservation are important considerations, and you need to strike a good balance. It is prudent and wise to get good advice from a trusted source that can guide you to match your investment with your IGWP objectives. It is important that your investment portfolio benefit from:

- a regular review of your and your family’s objectives;

- assessment of what is an appropriate length of investment for you;

- allocation of your portfolio;

- risk tolerance;

- diversification; and

- rebalancing - during COVID or post-pandemic, during pullback, correction or a bear market, review and consult regularly with your advisors.

Maximizing retirement savings and income as well as coordinating transition to retirement and proper planning of business succession are critical parts of this strategy. Many Canadians are finding retirement more complex than ever, as their priorities, investment needs, and even tax planning considerations evolve.

Families need to start having these conversations early, regularly, and include children at an early age. And parents, when working with advisors, need to delegate, not abdicate. Remember financial knowledge is not the same thing as financial wisdom. One is read, one is lived and therefore remembered.

Steps for investing with an IGWP mindset:

- Carefully look at your current situation. What are your present commitments, and will it have any impact on your decision to make new investments?

- Decide on the length of investment– short, medium, or long-term. Each has its own pros and cons. Be practical. Be wise.

- Understand your risk profile and your investing personality. Each of us have blind spots. Lets be open and honest. The core principle is to build, to diversify, and preserve wealth.

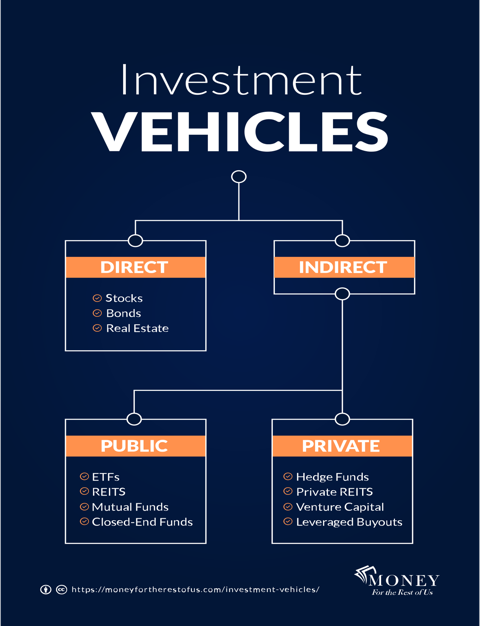

- What type of investments do you want to make? There are many choices. Make sure your allocation is diversified.

- Consider taxes and inflation. Consider the time value of your money. Get good advice from your advisory team.

- Speak with your family and advisors to guide and implement your strategy.

- Track your progress. You may want to rebalance your portfolio to better manage risk. It’s a big picture look at what the investments in your plan are doing. It’s also a way of protecting gains that you’ve made, since no investment style or asset class outperforms year after year. Rebalancing can help you protect yourself from rash, emotional investment decisions when investments fall in value.

If you want to learn more, here are some useful links: